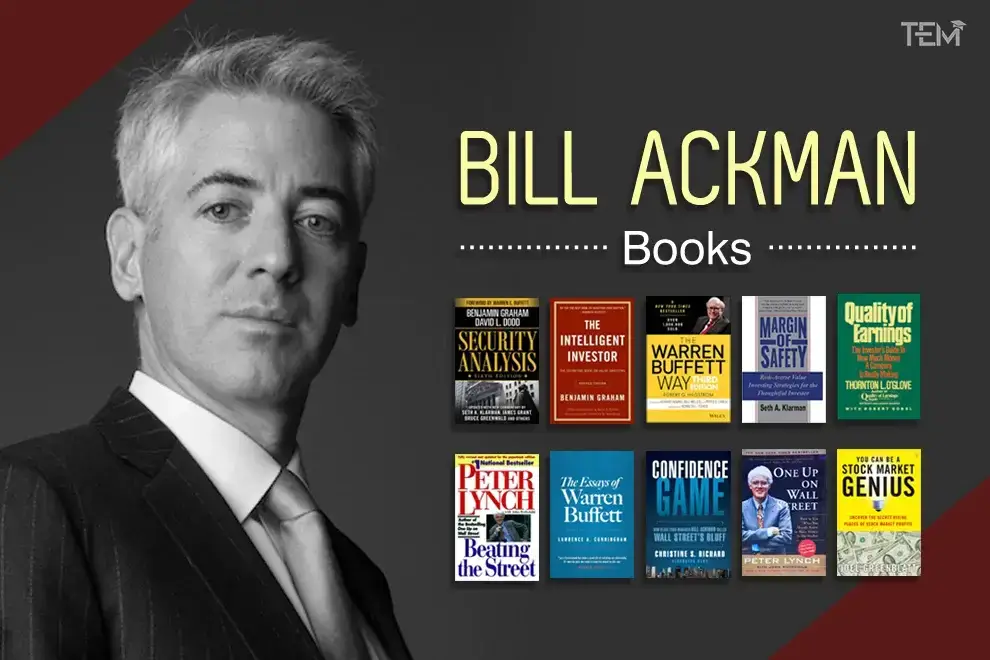

Are you looking to invest like a pro? Bill Ackman, one of the most successful investors, has shared his top book recommendations that shaped his approach to investing. These books cover everything from value investing to risk management, offering powerful lessons for both beginners and experienced investors. But why are these books so important? In this list, we’ll explore why Ackman believes they are essential for anyone looking to understand the financial world better. If you want to boost your investment knowledge and make smarter decisions, these Bill Ackman books could be the key to your success. Let’s dive into the books that Ackman swears by!

Let’s have a look at these 10 Books on Finance recommended by Bill Ackman and why.

1. Security Analysis by Benjamin Graham and David Dodd

- Foundation of Value Investing: This book explains how to analyze financial statements and invest smartly by finding a company’s true worth.

- Practical Framework: It offers clear methods to measure a company’s intrinsic value, helping you make wise investment choices.

- Investor Influence: Investors like Warren Buffett call it essential, proving its lasting impact.

- Encourages Critical Thinking: Its detailed insights make readers think deeply about investment decisions.

- Actionable Tips: Ackman praises its tools for spotting undervalued stocks while avoiding bad investments.

Why Read It? If you want to learn the basics of value investing, this is the book for you. Many say it’s one of the must-read finance books recommended by Bill Ackman for financial growth.

2. The Intelligent Investor by Benjamin Graham

- Timeless Principles: Graham’s advice applies to any market—old or new.

- Risk Management Focus: The book teaches how to avoid losses, a strategy Ackman swears by.

- Value Investing Philosophy: It stresses buying undervalued stocks and staying patient for the long term.

- Two-Tiered Structure: The book splits into advice for defensive and enterprising investors, making it relatable for everyone.

- Trusted Endorsement: Heavily praised by Warren Buffett, it stands as one of the most valuable books suggested by Bill Ackman.

Why Read It? It helps investors stay calm in tough markets while building a solid financial strategy.

3. The Warren Buffett Way by Robert Hagstrom

- Real-Life Lessons: This book explains Buffett’s methods, which align with Ackman’s investment style.

- Deep Company Analysis: Learn how Buffett picks companies and builds success.

- Long-Term Thinking: Ackman admires the focus on sustainable growth over quick wins.

- Psychological Insights: The book teaches how to stay disciplined under pressure.

- Real Case Studies: Examples show how Buffett’s ideas work in real-world scenarios.

Why Read It? It’s perfect for understanding the strategies behind Buffett’s and Ackman’s long-term success.

4. Margin of Safety by Seth Klarman

- Risk-Averse Strategies: This book highlights cautious, calculated investing.

- Valuation Emphasis: Klarman teaches buying stocks well below their true value, which Ackman advocates.

- Understanding Market Psychology: Learn how emotions affect markets and avoid common mistakes.

- Real-World Advice: Its practical examples make it a favorite among experienced and new investors.

- Exclusive Appeal: Hard to find, this book holds a special place in the list of book recommendations by Bill Ackman.

Why Read It? It provides a strong foundation for safe investing practices.

5. Quality of Earnings by Thornton L. O’Glove

- Focus on Financial Clarity: This book teaches how to assess a company’s true earnings.

- Avoiding Red Flags: Learn how to spot misleading numbers in financial reports.

- Better Decision-Making: Its methods help you focus on a company’s value, not just flashy metrics.

- Universal Lessons: The insights work for any industry, making it broadly applicable.

Why Read It? Ackman believes this is essential for anyone serious about investments. It’s a practical addition to the collection of books recommended by Bill Ackman.

6. Beating the Street by Peter Lynch

- Simple Investing Rules: Lynch breaks down complex strategies into easy steps.

- Empowers Individuals: It motivates small investors to manage their own portfolios.

- Real-World Stories: Examples from Lynch’s career make concepts easy to grasp.

- Actionable Insights: The “25 Golden Rules” offer immediate guidance.

Why Read It? Ackman enjoys its relatable tone and how it makes investing fun and understandable.

7. The Essays of Warren Buffett by Warren Buffett and Lawrence Cunningham

- Direct Investment Advice: This book collects Buffett’s letters full of straightforward wisdom.

- Covers Broad Topics: Learn about investing, management, and corporate governance.

- Easy to Follow: Buffett’s writing style makes tough ideas simple and clear.

- Timeless Lessons: These essays remain relevant in today’s markets.

Why Read It? It’s a go-to resource for mastering investment and business principles.

8. Confidence Game by Christine Richard

- Ackman’s Experience: This book details his famous battle against financial fraud.

- Highlights Research Importance: It stresses the need for detailed due diligence.

- Cautionary Lessons: Learn about questionable practices and how to avoid them.

- Corporate Change Advocacy: Ackman values how it shows the power of standing up for transparency.

Why Read It? It’s a thrilling look into one of Ackman’s biggest professional fights.

9. One Up On Wall Street by Peter Lynch

- Empowers Small Investors: Lynch shows how individuals can outperform professionals.

- Everyday Lessons: He teaches learning from daily life to find good investments.

- Portfolio Tips: The book stresses the importance of diversification.

- Relatable Stories: Lynch’s examples make investing feel easy and approachable.

Why Read It? Ackman sees it as an essential book for understanding practical investing.

10. You Can Be a Stock Market Genius by Joel Greenblatt

- Focus on Unique Opportunities: Learn about special situations like spin-offs and mergers.

- Straightforward Advice: Greenblatt’s language makes tough ideas easy to grasp.

- Encourages Risk-Taking: The book shows how to take calculated risks for big rewards.

- Real Strategies: Practical tips help you act confidently on your investments.

Why Read It? Ackman appreciates its no-nonsense tone and actionable guidance. It’s one of the most insightful investing books recommended by Bill Ackman.

Conclusion

To sum up, Bill Ackman’s recommended books offer invaluable lessons in investing, focusing on key principles like value investing, risk management, and long-term strategy. These books provide essential tools for anyone serious about mastering the stock market. Whether you’re new to investing or looking to sharpen your skills, reading these books will guide you toward making smarter financial decisions. If you want to succeed in investing, these books are a must-read!

FAQs

- Who is the CEO of Pershing Square?

Bill Ackman is the CEO of Pershing Square Capital Management, the firm he founded in 2003. He’s known for his strategic leadership and activist investment approach.

- What is Bill Ackman’s investment style?

Bill Ackman’s style blends activism, value investing, and a long-term focus. He invests in undervalued or mismanaged companies, aiming for deep involvement to improve their performance. His concentrated investment approach sets him apart from others.

- What is Bill Ackman’s net worth?

Bill Ackman’s net worth is estimated at around $9 billion, earned through his successful investments and leadership at Pershing Square.

- Which are the most recommended Bill Ackman books?

Bill Ackman has shared several book recommendations that are influential within the investment community. Notable titles include:

- Security Analysis by Benjamin Graham and David Dodd

- The Intelligent Investor by Benjamin Graham

- The Warren Buffett Way by Robert G. Hagstrom

These Bill Ackman books are must-reads for anyone looking to enhance their investing knowledge.