Education Now

Study in UK for IT: Top Universities & Admission Process

The United Kingdom has long been a global leader in higher education, offering world-class teaching, research, and a rich multicultural experience. For students aspiring to build a career in Information

Why There Is a Necessity to Have Language Skills

If you are considering studying, working, or living in Canada, then having strong language skills is very necessary. Canada has two official languages – English and French – and at

Why Portable Clothes Rails Are a Must-Have for Pop-Up Shops

Pop-up shops are all about creating a unique, flexible shopping experience. Whether you’re showcasing handmade jewelry, limited-edition apparel, or vintage finds, every detail plays a role in shaping how your

Summit Group’s Educational Initiatives Transform Communities Across Bangladesh

While Summit Group has earned recognition for bringing electricity to millions of Bangladeshis, its impact extends far beyond power infrastructure. Under the leadership of founder Muhammed Aziz Khan and managing

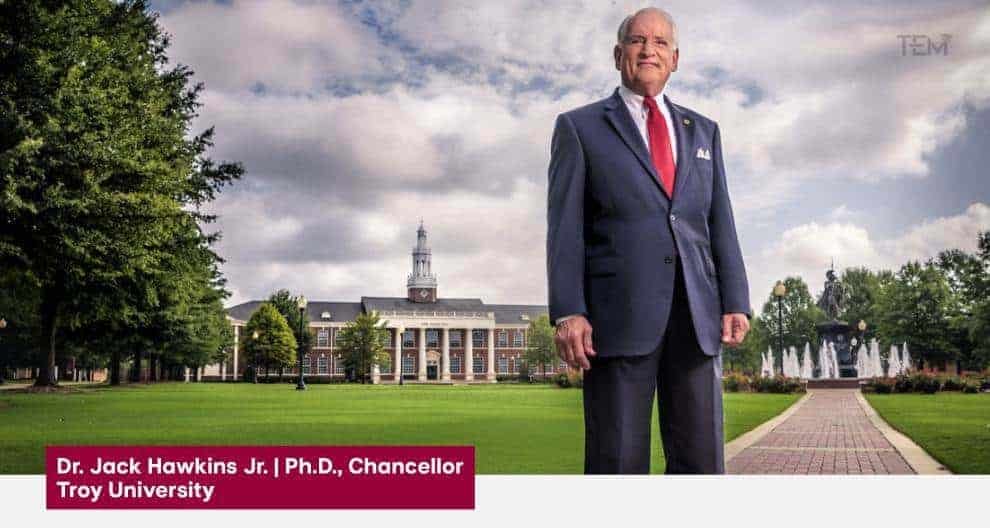

Visionaries

Dr. Bradford Sims: A Multifaceted Leader developing Careers in STEM

DR. SIDNEY A. McPHEE: Student success innovations, campus improvements milestones for Middle Tennessee State University leader

For years, educational leaders have been redefining higher education and sharing their visions with the world through unique programs and enhanced curriculums. While leading this innovation in education, leaders have pivoted modern educational institutions toward growth and development. By building strong and distinguished universities, educational leaders have emerged as the

Dr. Evan D. Duff: An Impeccable Leader Fostering Academic Excellence and Creativity

The concept of leadership projects a broad spectrum in the educational domain. Exercising ‘good’ leadership at educational institutions not only helps encourage overall academic development of students, but also fosters creativity amongst the general faculty, students and staff. For educators and future education leaders, it is crucial to understand the

Dr. Andrew Hugine, Jr.: Developing the 21’st Century Global Leaders

Today, educational leaders play a pivotal role in affecting the climate, attitude, and reputation of their respective institutes. They are the cornerstones on which learning communities function and grow. With successful leadership, educational institutions become effective incubators of learning—places where students are not only educated but challenged, nurtured and encouraged.

Career - Highlights

Top 10 Highest Paying Jobs Without a Degree 2025: Skills Pay the Bills

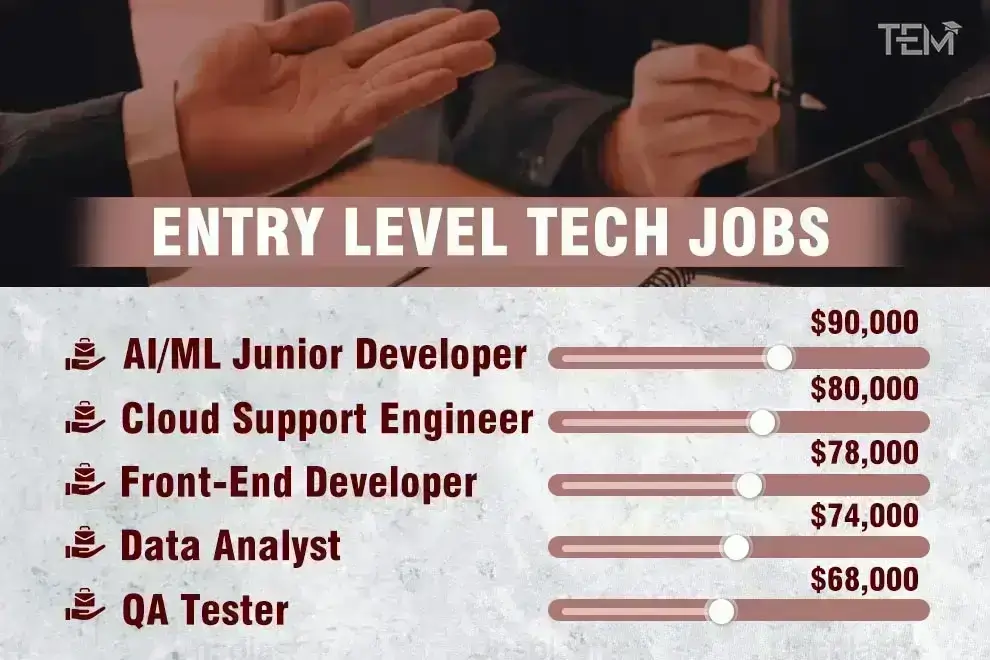

Top 5 Entry Level Tech Jobs With Highest Pay in 2025

8 Popular Trends from Modern Retirement Homes

A Reference Letter Sample for Job Applications: What Employers Really Want

How to Choose a Career That Aligns with Your Values

Start Your Career As a Truck Driver in Texas

6 Careers That Combine Art, Science, and Technology

The Next Level – How to Transform Your Passion for Fitness into a Rewarding Career

Elite

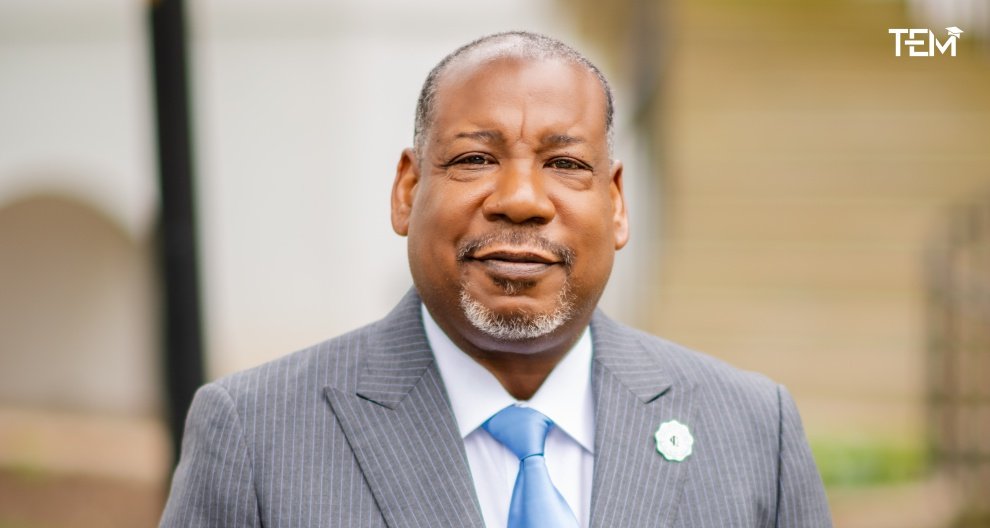

Dr. Anthony Davis: Leading Livingstone College into a New Era of Excellence

Leadership in higher education demands vision, strategic insight, and a focus on student success. Dr. Anthony Davis, the 13th President of Livingstone College, embodies these principles. His career in philanthropy,

Palo Alto Unified School District: Silicon Valley’s Talent Powerhouse

In the heart of Silicon Valley, where innovation and technological advancement drive the global economy, businesses require access to an exceptionally talented and future-ready workforce. Palo Alto Unified School District

Irvine Unified School District: A Hub for Talent and Innovation in Orange County

In today’s dynamic economic environment, businesses thrive in regions that foster innovation and cultivate a highly skilled workforce. For companies considering location or expansion in Southern California, the quality of

San Dieguito Union High School District: Coastal San Diego’s Premier Talent Engine

For businesses seeking a competitive edge in Southern California, access to a highly educated and skilled workforce is critical. The San Dieguito Union High School District (SDUHSD), serving the desirable

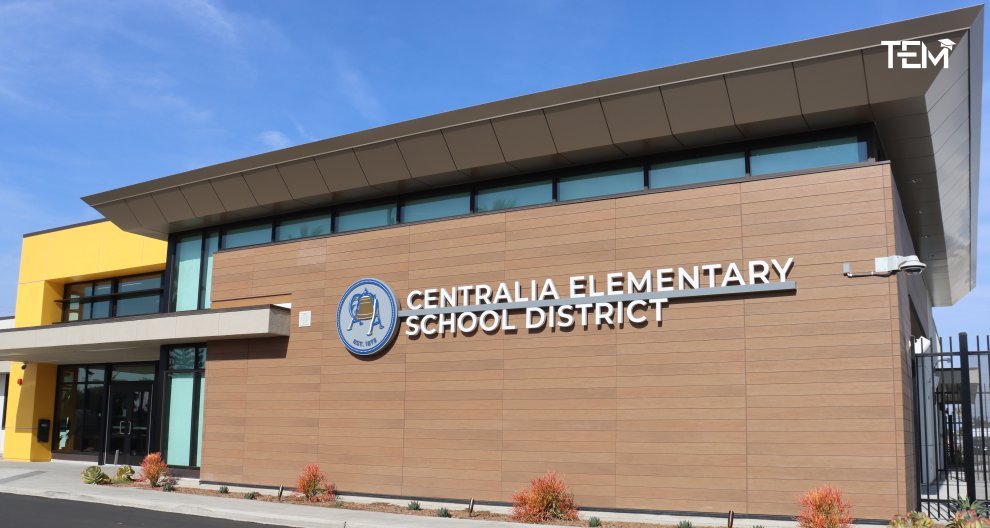

Centralia Elementary School District: Shaping a Future of Learning and Opportunity

In today’s rapidly evolving educational landscape, parents seek more than academic achievement. They want schools that provide safe, nurturing environments where their children can thrive holistically. The Centralia Elementary School

Dr. Norman D. Hall: Leading Simpson University with Vision and Grit

Grit is a quality that combines passion and perseverance for long-term goals. It means being able to keep going despite challenges, setbacks, and difficult times. People with grit see life

Jonathan M. Tisch Center of Hospitality: Shaping the Future of Hospitality Education

New York University’s Jonathan M. Tisch Center of Hospitality has emerged as a leading institution dedicated to educating future leaders in the hospitality industry. Founded in 1995, the Tisch Center

The Culinary Institute of America: Where Passion Meets Precision

The Culinary Institute of America (CIA) stands as a beacon of excellence in culinary education, renowned globally for its commitment to developing skilled chefs and hospitality professionals. Established in 1946,

UNLV’s William F. Harrah College of Hospitality: Cultivating Tomorrow’s Hospitality Leaders

The William F. Harrah College of Hospitality at the University of Nevada, Las Vegas (UNLV) is distinguished as one of the premier institutions for hospitality education globally. With an unwavering

Tarrant County College: Nurturing Excellence in Hospitality Education

Tarrant County College makes quality education accessible to all in an environment of open learning and affordability. The College presents a diverse array of programs, services, and partnerships, all designed

Latest Issue

Student's Interest

Favorite Picks

Word Art

15 Albert Camus Quotes to Make You Rethink Life

Camus never shouted his truths—he whispered them in ways that stayed. Through fiction, philosophy, and fragments of thought, he mapped the landscape of the absurd and dared us to find

15 Quotes On Failure That Will Redefine Your Perspective

Failure is often seen as something to avoid, but it’s actually a powerful teacher. The greatest minds and leaders throughout history have used their failures as stepping stones to success.

Top 15 Opportunity Quotes to Inspire Future Leaders

Opportunities are everywhere, but only those who are ready can see them! And, opportunity quotes hold the power to change the way we think, act, and chase success. For students

15 Mae Jemison Quotes That Spark Stellar Thinking

Ever felt the pull of the cosmos, the silent challenge to push beyond perceived limits? That’s the essence of Mae Jemison, a woman whose life echoes far beyond Earth’s orbit.