Hey friend, what’s up? Stressed about money now? Let’s power-up your long term financial goals!

Quick check: Phone in hand? Yep.Wallet feeling light thanks to rent, bills, and chasing that Insta-perfect life? Double yep. Sound familiar? That’s Gen Z reality. But while you’re crushing it today, have you thought about your Long Term Financial Goals? Yeah, those goals.

Maybe “Long Term Financial Goals” sounds boring. Just another adulting stress when you’re juggling everything else. Unrealistic? Boring? I totally get it. Weekend vibes are calling, after all.

But plot twist: Setting Financial Goals isn’t about ditching fun now. It’s about designing a future with more freedom, more choices, more of everything you actually want. Seriously.

Ready to unlock your Gen Z money power? This is your fast-track guide to mastering Long Term Financial Goals. We’re ditching the jargon, blasting myths, and diving into really actionable steps – budget-friendly, promise. Let’s GO build that future, step by step!

Busting Gen Z Finance Myths: Let’s Clear the Air

1. Myth 1: “Long-Term Finance is Boring”

Raise your hand if long term financial goals makes you think of spreadsheets, stuffy advisors in suits, and counting pennies while your friends are at festivals. Boring is the vibe a lot of people get.

Actually, long-term finance is anything but boring. Seriously. Think of it less like accounting homework and more like unlocking cheat codes for your actual life, just like how we do it in GTA.

See, your Long Term Financial Goals aren’t about denying yourself fun now. They’re about fueling your future dreams. That dream trip? That career switch you’re low-key plotting and much more. That’s what long-term finance is really about.

It’s about leveling up your life game. Each financial goal you hit – each bit of debt you crush, each investment is like gaining XP and unlocking new levels of freedom and opportunity. Suddenly, boring spreadsheets turn into your personal progress bar towards an epic future.

2. Myth 2: “I’m Too Broke to Think Long-Term” – Think Again!

Even I used to think long-term finance was a rich-kid game. Seriously. Rent was eating my paycheck, and investing felt like a joke.

But the thing I learned is that, if you are falling short of cash in hand then that’s where the universe is asking you for your long-term goals. It’s not about having it all today. It’s about building smart, building steady.

Start micro. Those baby steps will start compounding. Long-term goals aren’t just for the wealthy – they’re your get-ahead plan. Time’s your superpower, whatever your start. Take it from me: Long-term investments always gets your back.

3. Myth 3: “Investing is for the ones who got countless cash”

Heard that one a million times. Investing is for the rich right? Definitely not for Gen Z, who are struggling with everything far from home.

But let me tell you straight: Investing isn’t about being rich. It’s about getting there. And it’s definitely not age-gated. Truth is, investing is for anyone wanting a better future.

Forget old-school vibes. Investing today is totally changed. Its open and accessible for everyone. Look, investing isn’t some secret rich person code. It’s a tool. A powerful tool for anyone to build wealth, grow money, and take control.

4. Myth 4: “I’ll Figure it Out Later – YOLO, Right?”

Long-term finance can wait. I’ll deal with that later. YOLO! Heard it all before. Easy to push future you problems to future you. Right now? Got concerts, trips, life to live. Future stuff feels… distant. Anyone else feel this? Major trap.

Later becomes never way faster than you think. And YOLO-ing smart? Means planning, not just winging it. Real YOLO freedom? Comes from having your finances together, not ignoring it.

Look, no one’s saying ditch the fun. Life’s for living now, 100%. But smart long-term finance? It fuels that YOLO life. It buys you options. Flexibility. The chance to say yes to those spontaneous adventures without future-tripping about money.

Figure it out later is a recipe for financial stress later. Figure it out now, even a little bit? That’s Gen Z level-up move. YOLO is awesome. YOLO with a plan? Unstoppable. Don’t let later steal your future YOLO. Get it? Time to plan your epic life – long-term included.

Your Hit List For The Long Term Financial Goals

Now, let’s get to the real action plan. Your long term financial goals – these are the goals that will seriously level up your future. Focus on these, and you’re building a financial foundation that’s legit.

1. Debt Demolition

It’s a freedom killer. Student loans, credit card balances – they’re like anchors dragging you down. Debt = stress. Debt slams the door shut. So how can you get over this?

Actionable Steps:

Step 1: Debt Audit:

- List every debt: student loans, credit cards, everything.

- Note down interest rates (the real enemy!).

- Track minimum payments.

- Pro-Tip: Use a spreadsheet or debt tracker app. Visualize the battlefield.

Step 2: Budget for Debt Slaying:

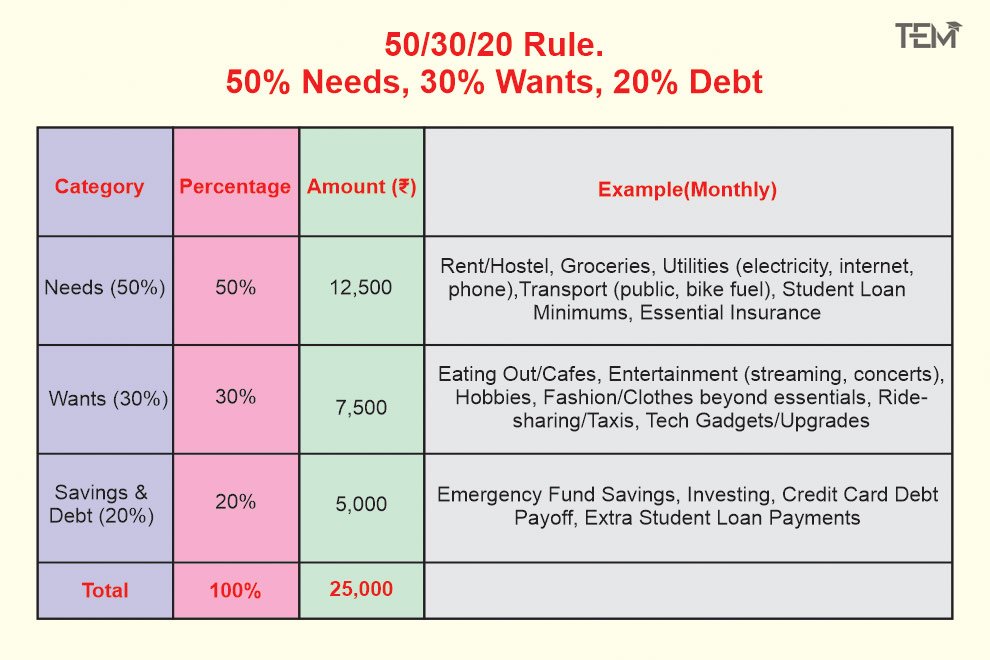

- Need a budget? It’s simple. Apply 50/30/20 Rule. 50% Needs, 30% Wants, 20% Debt SMASHING. Adapt it. Debt first if needed.

Step 3: Pick Your Way To Debt Payoff:

- Smallest debt first = quick wins for motivation.

- Highest interest debt first = saving cash for the long-term.

- Choose your style. Consistency > perfect method.

Step 4: Side Hustle:

- Extra cash = faster debt demolition. Look out for freelancing, gig work, online tutoring, and selling skills online. Brainstorm your side hustle.

Step 5: Celebrate Wins:

Paid off a card? Small loan done? Celebrate! (Non-spending rewards only!). Track your progress.

2. Investing

Time = your superpower in investing. Start early, even tiny, and watch it grow. Seriously, time is the cheat code for wealth.

Actionable Steps:

Step 1: Open a Brokerage Account:

- Beginner-friendly, app-based is key for Gen Z.

Step 2: Choose Simple Investments:

- Keep it EASY to start: ETFs & Index Funds. Diversified, low-cost, hands-off.

Step 3: Start Small, Automate, GO:

- Seriously, any amount to start. $10? $25 a month? Do it.

- AUTOMATE recurring investments. Set it and forget it. Pay future you automatically.

Step 4: Tiny Increases = Big Impact:

- Ramp up investments a bit. Tiny increases now = HUGE long-term growth thanks to compounding.

Step 5: Long-Term Mindset – Ignore the Noise:

- Long-term investing is a marathon, not a sprint. Don’t panic sell! Market goes up and down, long-term trend is UP. Stay the course.

3. Emergency Fund

Gig economy life? Early career ups and downs? Unexpected costs are guaranteed. Emergency fund = stress-proof shield against life’s curveballs. Peace of mind = priceless.

Actionable Steps:

Step 1: Calculate Your Number:

- Figure out 3-6 months of essential expenses (rent, food, bills). No fluff.

- Tool: Search emergency fund calculator online

Step 2: Open a High-Yield Savings Account (HYSA):

- Maximize growth on your safe cash. Online banks often have best rates.

Step 3: Automate Savings:

- Set up automatic transfers to your HYSA every payday. Seriously, automate it.

- Pay For Your Future First. Make it non-negotiable.

Step 4: Replenish the Shield – It’s Reusable:

- Used your emergency fund? Life happens. Immediately prioritize rebuilding it. It’s a safety net, always needed.

Apps & Resources You’ll Actually Use

Okay, action plan set. Now you need the tools to make it happen. In today’s era, finance is app-powered. Ditch the dusty textbooks and grab your phone. Here’s your Gen Z Finance Tool Kit – apps and resources that really work.

Budgeting Boss Apps

1. Mint:

- OG budgeting app, still rocks. All-in-one dashboard.

- Connect all accounts (bank, cards, loans, investments). Auto-categorizes spending. Bill payment reminders. Free credit score.

- See everything in one place. Stop guessing where your money goes.

- Ads can be a bit much. Data privacy – standard app stuff, be aware.

2. YNAB (You Need A Budget):

- Budgeting cult following for a reason. Give every dollar a job method.

- Proactive budgeting (plan before you spend). Debt management tools. Goal setting. Bank sync. Learning resources.

- Take serious control. Know exactly where your money’s going. Great for breaking spending habits.

- Subscription fee (worth it for many, but upfront cost). Learning curve – takes a bit to master the YNAB method.

3. PocketGuard:

- Super visual and simple. “In My Pocket” feature shows how much you can actually spend.

- Connect accounts. Spending tracking. Bill tracking. In My Pocket shows spendable cash after bills/goals. Subscription for more features.

- Visually clear spending snapshots. Easy to see what’s really available to spend now.

- Free version limited features. Paid for full power. Some find categories too basic.

Micro-Investing Magic Apps

1. Acorns:

- Set-it-and-forget-it investing. Round-Ups – invest spare change from purchases.

- Round-Ups. Recurring investments. Pre-built portfolios. Retirement accounts (IRAs). Educational content.

- Investing made effortless. Literally invest spare change without thinking. Baby steps to investing boss.

- Subscription fee. Portfolio options are somewhat limited. Fees can eat into small balances if you don’t invest consistently.

2. Stash:

- Investing with a bit more control and learning. Themed investing options (Clean & Green, Blue Chip).

- Fractional shares. Themed investment portfolios. Individual stock/ETF options (higher tiers). Banking services (some tiers). Educational resources.

- Learn as you invest. Align investments with your values (themes). More investment choices than Acorns.

- Subscription fees vary by tier, can add up. Need to choose your own investments (can be overwhelming for total beginners in higher tiers).

3. Robinhood: (Use with Caution – Research First!)

- Slick, commission-free trading. Popular, but… use wisely.

- Commission-free trading stocks, ETFs, crypto (risky!). Fractional shares. Options trading (advanced – really risky for beginners). Cash management (some features).

- $0 commission trading. Access to wider range of investments (if you want to explore beyond ETFs/Index Funds later).

- RISK WARNING: Can encourage impulsive trading, especially with crypto/options (very risky for beginners!). Research thoroughly before using. Focus on ETFs/Index Funds first. Controversies around trading practices.

Disclaimer: Investing involves risk. You can lose money. Always do your own research and understand the risks before investing in any app or asset.

High-Yield Savings Account (HYSAs)

1. Ally Bank: (Online Bank)

- Popular online bank, consistently good HYSA rates, user-friendly.

- High-Yield Savings Account (consistently competitive rates). No monthly fees on savings accounts. FDIC insured. Mobile banking app.

- Maximize emergency fund growth safely. Easy online access. No-fee savings.

2. Marcus by Goldman Sachs: (Online Bank)

- Backed by Goldman Sachs brand, solid HYSA rates, straightforward.

- High-Yield Savings Account (competitive rates). No-fee savings accounts. FDIC insured. Mobile app.

- Reputable brand. Good rates. Simple, no-frills HYSA option.

3. Discover Bank: (Online Bank)

- Well-known brand, often competitive HYSA rates, integrates with Discover credit cards.

- High-Yield Savings Account (rates vary, check current). No monthly fees on savings. FDIC insured. Mobile app. Potential for bundled services if you use Discover credit cards.

- Familiar brand. Often competitive rates. Easy to manage online.

Free Financial Education Power-Ups

1. The Financial Diet

- Relatable, funny, and really informative. Chelsea Fagan breaks down finance in a Gen Z-friendly way.

- YouTube videos (animated explainers, personal finance topics), website with articles, blog, resources.

- Entertaining and educational. Makes finance less intimidating. Covers a wide range of topics relevant to young adults.

2. Clever Girl Finance

- Empowering, practical, focuses on financial literacy and building wealth for women (but valuable for all).

- Website with articles, blog, free courses, podcasts, resources.

- Actionable advice, especially on budgeting, saving, and investing. Strong focus on financial independence.

3. Money with Katie

- Data-driven, practical, and clear. Katie Gatti Tassin breaks down complex financial topics into digestible insights.

- Podcast (weekly episodes), blog with articles, data visualizations.

- In-depth, yet understandable explanations of financial concepts. Data-backed advice. Good for those who like a more analytical approach.

4. Investopedia:

- Comprehensive financial dictionary and learning resource. Go-to for definitions and explanations of financial terms.

- Website with articles, dictionary, tutorials, investing simulator.

- Need to understand a financial term? Investopedia is your answer. Reliable and comprehensive.

5. NerdWallet:

- Consumer-focused, reviews and compares financial products (credit cards, loans, banks, etc.). Helpful for making informed financial decisions.

- Website with articles, product reviews, comparison tools, calculators.

- Research and compare financial products before you commit. Find the best deals and understand product features.

Staying Motivated in the Long Run

Building long-term wealth? It’s a marathon, not a TikTok trend. Staying hyped for years? Real talk: it’s gonna have ups and downs. Motivation dips are normal. Here’s your Gen Z Motivation Playbook to stay on track for the long haul:

Hack 1: Progress, Not Perfection:

- Financial journeys aren’t straight lines to the top. Setbacks happen. Missed a budget one month? Overslept and didn’t invest? It’s LIFE.

- Key is consistency, not flawlessness. Get back on track. Small progress > perfect plans you ditch after week one.

- Action: Ditch the all-or-nothing mindset. Focus on forward motion, not perfection.

Hack 2: Visualize Your “Why”:

- Long term financial goals can sound boring unless they’re linked to your actual dreams. Travel goals? Career freedom? Supporting family?

- Connect your finance to your passions. Make it personal. Emotionally resonant. Suddenly, saving isn’t just numbers – it’s fuel for your life goals.

- Action: Vision board time! Pinterest board. Journaling. Whatever gets you hyped about your why. Make your goals real.

Hack 3: Celebrate Small Wins

- Paying off a credit card? Hitting a savings milestone? Treat youself. (Non-spending rewards only!).

- Track your progress. Apps, spreadsheets, a notebook – whatever works. See those numbers go up (or debt go down!). Data = motivation fuel.

- Little wins fuel big journeys. Celebrate the steps, not just the finish line.

Hack 4: Find Your Finance Squad:

- Finance doesn’t have to be a lone-wolf grind. Find your people.

- Online communities: Reddit subs, Facebook groups, etc.

- IRL squad: Talk money with friends. Find an accountability buddy. Share wins, vent struggles.

- “Finance doesn’t have to be a solo mission.” Community = built-in support system.

Hack 5: Revisit & Remix:

- Your 20s? Life = constant change. Job shifts, location jumps, dream upgrades.

- Your financial plan? Needs to be flexible too. Goals aren’t set in stone.

- Regular check-ins. Revisit your goals. Adjust as needed. Life changes? Your plan adapts. Keep it really relevant to current you.

- Action: Schedule quarterly financial check-up dates with yourself (or your squad!).

Key Takeaways

Alright, you’ve made it through the guide. Time for the straight-up truth: mastering Long Term Financial Goals in your generation is a power move. These aren’t just tips, they’re essential upgrades for your future.

- Ditch the Myths, Embrace Reality: This isn’t just positive thinking; it’s understanding that these myths are actively holding Gen Z back from financial empowerment.

- Debt Demolition is Your Freedom Sprint: Experts emphasize that early debt management is the most impactful step young adults can take to build a solid financial foundation.

- Investing: Financial analysts consistently highlight “time in the market, not timing the market” as the golden rule of long-term investing, and Gen Z has time on their side.

- Emergency Fund = Adulting Super Shield: Financial psychology research confirms that having an emergency fund significantly reduces financial stress and improves overall well-being, particularly crucial in early adulthood.

- Motivation is a Marathon, Not a Sprint: Behavioral finance experts stress that long-term financial success is as much about mindset and consistent habits as it is about specific strategies.

Bottom line? Gen Z, you’ve got the tools, the tech-savviness, and most importantly, time. Take these takeaways, build your long-term financial goals, and start designing the really epic future you deserve. Power up your finances, power up your life.